Which online accounting software fits your needs depends on your wishes and requirements. Or you can handle your own administration. You can collect your receipts and outsource everything to your accountant. You can do your administration in different ways. Which accounting package fits your business? Manually via an online portal of an ICT service provider, if you do not use an electronic accounting programme.This is the e-invoice that your accounting software creates. Through an email with an XML attachment.

ONLINE INVOICING FREE HOW TO

Check with the Netherlands Peppol Authority how to use Peppol. There are various ways to send e-invoices to local authorities such as water boards, municipalities, and provinces: Are you participating in a tender? Then e-invoicing is often mandatory. Municipalities, provinces, and water boards are also able to receive e-invoices. Is e-invoicing mandatory?Įntrepreneurs who do business with the central government are obliged to send e-invoices. This makes it possible to automatically process e-invoices in your records and in your customer's administration.ĭo you find it difficult to use e-invoicing? RVO has made an infographic (in Dutch) so you can determine which way of e-invoicing suits your company best. The data required on an e-invoice is in a fixed place with its own coding. Through e-invoicing, your invoice is always sent via a secure server and always correctly received. E-invoicing is not simply sending a scanned invoice, but a digital invoice in XML format. You should preferably send an electronic invoice (e-invoice) to your customers. You can also use factoring or a debt collection contract, if necessary. There are entrepreneurs who offer customers a discount if they pay the invoice immediately. State the payment term clearly in your invoice. You can offer various payment options: payment in advance, immediately on delivery, or within a payment term. You can do this in advance in your quotation and general terms and conditions. Then the invoice must be sent before 15 September.Ĭlearly state when the invoice must be paid. This is called the issue date and is determined by the Tax and Customs Administration.Įxample: You completed your assignment on 5 August. In any event, send your invoice before the 15th day of the month following the month you delivered your product or service. Your work or delivery will still be fresh in their memories.

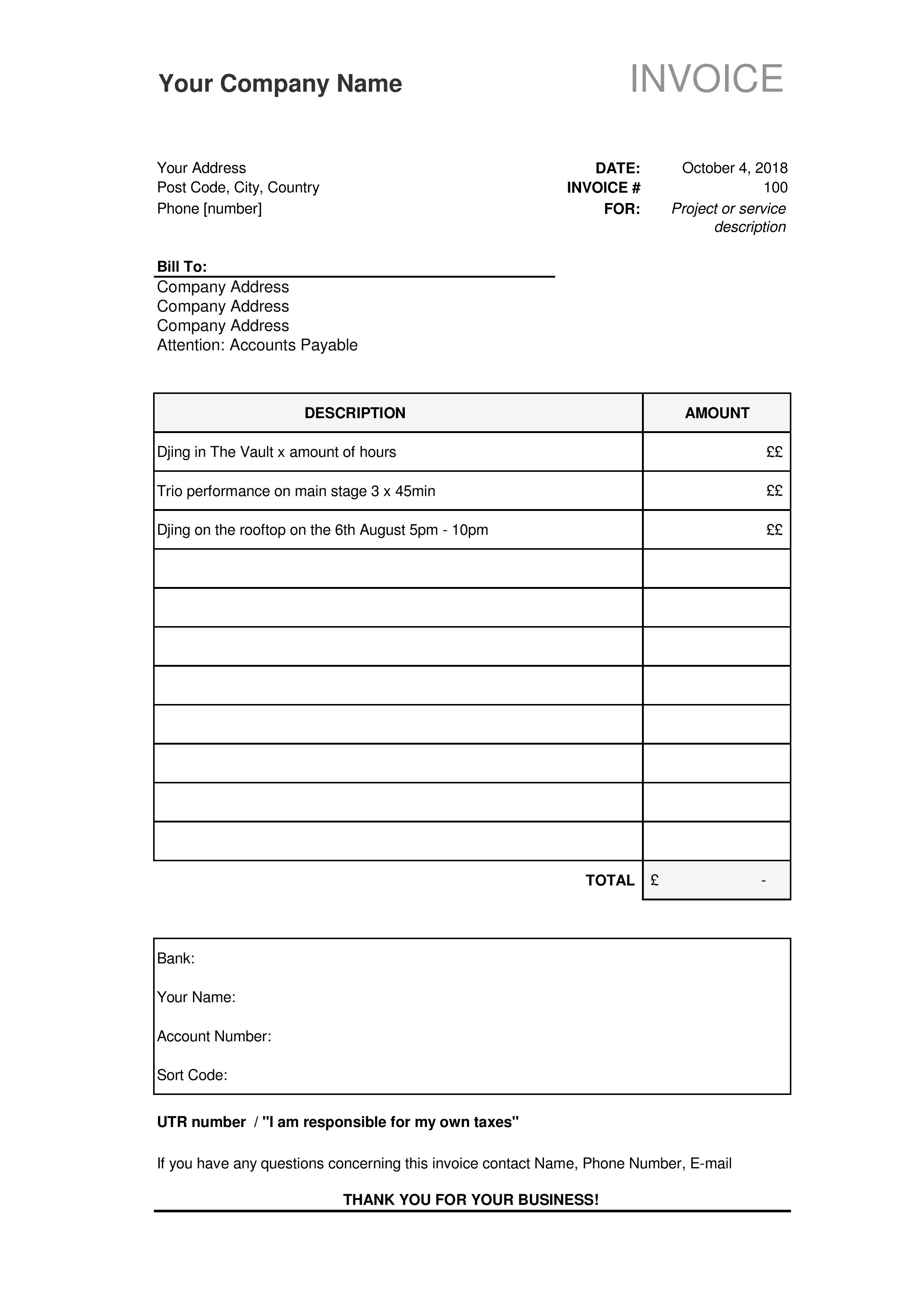

Send the invoice to your customer as soon as possible after finishing the job. Send your invoice right after finishing the job This invoice example from the Netherlands Chamber of Commerce KVK (pdf) helps you create your own invoice format. If you invest in the format and layout of your invoice from the start, this will save you time later on. At a glance, your customer can see the amount to be paid, the payment term, and your bank account details or payment link. Your logo and company name need to stand out immediately. Make sure your invoice has a clear layoutĪn invoice must look clear and well-organised. Use these 10 questions to determine which actions will help you be GDPR-proof and avoid any fines. For example, when you process customer information to draw up an invoice, that already falls under the GDPR. You also store personal data in your records. You have to be able to prove exactly what you use (potential) customer data for and how long you store the data. Anyone who works with personal data must comply with the GDPR. The General Data Protection Regulation (GDPR) is the privacy law that applies for all entrepreneurs since May 2018. Which goods or services you have supplied.Is the invoice amount, including VAT, less than €100? Then you can write a 'simplified' invoice (in Dutch), with at least the following information: Purchasing invoices must be kept in the administration. Your invoice does not have to comply with the invoicing requirements. You can explain this by stating that you are exempt from VAT. If you do, do not include a VAT percentage or VAT amount. Tip: are you making use of the Small Businesses Scheme (KOR)? You do not have to send an invoice but you can. You can find all the invoice requirements on the website of the Tax and Customs Administration. Your name and address and that of your customer.The invoice date and number (your invoices must be consecutively numbered).

ONLINE INVOICING FREE REGISTRATION

Your KVK number (from your registration in the Commercial trade Register).The total amount due, excluding and including VAT.Your VAT identification number and the VAT rate that is applied.The following must be stated on your invoice:

0 kommentar(er)

0 kommentar(er)